DOGE Price Prediction: Path to $1 Amid Institutional Frenzy and ETF Catalyst

#DOGE

- Technical Breakout Potential: Current price above key moving averages with Bollinger Band expansion suggesting continued momentum

- Institutional Accumulation: CleanCore's massive DOGE purchases creating supply shock potential

- ETF Catalyst: September 18th launch date providing near-term price catalyst and legitimacy

DOGE Price Prediction

Technical Analysis: DOGE Shows Bullish Momentum Above Key Moving Averages

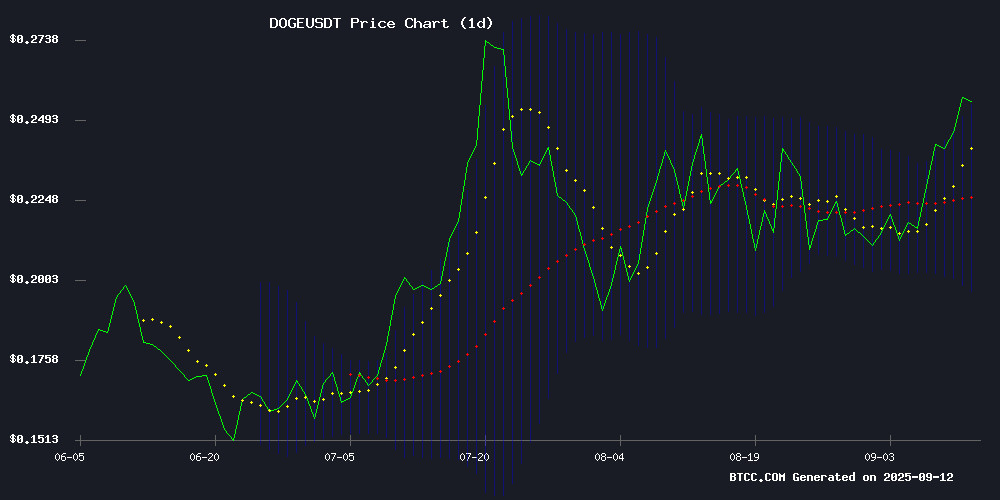

DOGE is currently trading at $0.277, significantly above its 20-day moving average of $0.226, indicating strong bullish momentum. The MACD reading of -0.008582 suggests some near-term weakness, but the narrowing histogram at -0.008461 shows decreasing bearish pressure. Price action above the Bollinger Band middle line at $0.226 confirms the upward trend, with potential resistance NEAR the upper band at $0.261.

According to BTCC financial analyst Olivia, 'The technical setup suggests Doge has room for further upside, though traders should watch for potential consolidation near the $0.26 resistance level.'

Market Sentiment: Institutional Accumulation and ETF Hopes Drive Optimism

Recent news flow surrounding Dogecoin has turned decidedly bullish. CleanCore's massive accumulation of over 500 million DOGE tokens demonstrates growing institutional interest, while the upcoming Dogecoin ETF launch on September 18th has created substantial market anticipation. Rate cut speculation and broader crypto IPO momentum are providing additional tailwinds for DOGE's price action.

BTCC financial analyst Olivia notes, 'The combination of institutional accumulation and ETF excitement creates a fundamentally supportive environment for DOGE, though traders should remain cautious of potential 'sell the news' scenarios post-ETF launch.'

Factors Influencing DOGE's Price

CleanCore’s Dogecoin Treasury Nears 1 Billion DOGE Target with 500 Million Purchase

CleanCore Solutions has aggressively advanced its Dogecoin accumulation strategy, purchasing 500 million DOGE to reach the halfway mark of its 1 billion target within 30 days. The move follows an earlier acquisition of 285.42 million DOGE, signaling institutional confidence in the meme coin’s long-term utility.

Backed by the dogecoin Foundation and its corporate arm House of Doge, the treasury aims to secure 5% of DOGE’s circulating supply. Custodied on Bitstamp via Robinhood, the holdings are positioned to support emerging use cases in payments, tokenization, and global remittances.

"Crossing 500 million Doge demonstrates our execution speed," said Marco Margiotta, CleanCore’s Chief Investment Officer. The firm is developing staking-like products and real-world applications to cement Dogecoin’s role as a reserve asset.

Dogecoin Surges on Rate Cut Speculation and Crypto IPO Momentum

Dogecoin (DOGE) rallied 7.8% in 24 hours as macroeconomic Optimism and bullish crypto IPO debuts fueled risk appetite. The meme coin's jump coincided with Nasdaq gains and two high-profile public listings—blockchain lender Figure and Gemini-backed exchange Bullish—both trading significantly above their IPO prices.

Market sentiment pivots on expectations of Federal Reserve rate cuts following softening labor data, despite persistent inflation. Lower borrowing costs traditionally benefit speculative assets like DOGE. The simultaneous success of crypto-adjacent IPOs signals sustained institutional interest in digital asset exposure.

As a sentiment-driven asset, Dogecoin remains hypersensitive to market narratives. Today's rally underscores how macroeconomic catalysts can override its typical meme-driven volatility, though fundamental weaknesses persist given its lack of utility.

Dogecoin ETF Launch Anticipation Fuels Market Speculation

Dogecoin's price trajectory shows bullish signals as the crypto market anticipates the debut of the first meme coin ETF. Trading volume surged 4% in 24 hours, with $DOGE testing key resistance at $0.26. A breakout above this level could trigger a 200% rally, according to technical analysis.

The ETF's launch, now delayed to mid-week, represents a watershed moment for meme coins. Institutional-grade exposure could catalyze a sector-wide supercycle, with Dogecoin positioned as the prime beneficiary. Market participants are rotating capital into $DOGE ahead of the event, outpacing newer meme coin competitors.

Price action reveals a tightening consolidation pattern between support and resistance zones. Sustained momentum post-ETF approval may target higher psychological levels, though volatility remains elevated. The product's success could validate meme coins as an asset class beyond retail speculation.

Dogecoin ETF Launch Moved to Sept 18: Price Rallies as DOJE Hits Markets

Dogecoin surged to a six-week high amid growing anticipation for its upcoming ETF launch. Traders and investors are rallying behind the meme coin as the first-ever Dogecoin ETF, dubbed DOJE, prepares to debut on September 18.

The price rally reflects renewed speculative interest in Dogecoin, which has historically benefited from retail enthusiasm and high-profile endorsements. Market participants are positioning for potential volatility around the ETF's introduction.

CleanCore Nears Halfway Mark in 1 Billion DOGE Treasury Accumulation

CleanCore Solutions has aggressively acquired over 500 million Dogecoin, signaling strong institutional confidence in the meme cryptocurrency. The $130 million purchase this week follows a 285 million DOGE buy, demonstrating execution speed that outpaces typical corporate treasury strategies.

'Crossing this threshold isn't just about quantity—it's about validating DOGE as a reserve asset,' said Marco Margiotta, CleanCore's CIO. The company collaborates with both the Dogecoin Foundation and House of Doge to position the token for payments and remittance use cases.

Market response has been immediate. DOGE posted 23% weekly gains as ZONE stock rebounded following a $175 million private placement. CleanCore aims to complete its 1 billion token target within 30 days, a timeline that WOULD make it the largest corporate DOGE holder.

CleanCore Solutions Expands Dogecoin Treasury to Over 500 Million DOGE

CleanCore Solutions has significantly bolstered its Dogecoin reserves, surpassing 500 million DOGE in a strategic treasury expansion. The MOVE underscores growing institutional interest in meme-inspired cryptocurrencies as viable treasury assets.

The acquisition forms part of an accelerated treasury management strategy, positioning Dogecoin alongside traditional corporate reserve assets. Such large-scale accumulation by institutional players continues to validate DOGE's transition from internet joke to mainstream financial instrument.

Dogecoin ETF Speculation Divides Traders as DOGE Approaches Key Resistance

Dogecoin traders are positioning for volatility as DOGE tests the $0.25 supply wall, with market sentiment split on the potential impact of a proposed ETF. The memecoin's 2021 bull run—fueled by Elon Musk's endorsements and retail frenzy—remains a cautionary tale of how HYPE can detach price from fundamentals.

Current funding rates at -0.68% reflect growing bearish pressure, yet the specter of ETF-driven liquidity looms. The 2024 breakout mirrors early stages of the last cycle, but whether history repeats or reverses hinges on whether institutional participation can sustain the rally beyond meme-driven speculation.

Dogecoin Gains Momentum Amid Institutional Interest Despite ETF Delay

Dogecoin (DOGE) surged nearly 20% over the past week to $0.25, its highest level since mid-August, outpacing all other top-ten cryptocurrencies excluding stablecoins. The rally follows CleanCore Solutions' significant accumulation and renewed speculation around a potential US-listed ETF.

Rex-Osprey's planned Dogecoin ETF (ticker: DOJE) has been delayed to September 12, according to Bloomberg analyst Eric Balchunas. The novel offering—an ETF 'that has no utility on purpose'—has sparked debate while fueling market anticipation. Prediction markets now assign a 66.6% probability DOGE reaches $0.30 rather than dropping to $0.15.

Institutional activity appears to be driving momentum. CleanCore's strategic purchase coincides with growing derivatives interest, suggesting sophisticated investors are positioning for volatility. The meme coin's resurgence defies its 2021 highs but demonstrates crypto's evolving narrative—where speculative assets gain traction through structured products.

Will DOGE Price Hit 1?

While DOGE shows strong technical and fundamental momentum, reaching $1 would represent a 261% increase from current levels around $0.277. This target appears ambitious in the near term but becomes more plausible when considering the following factors:

| Factor | Impact | Probability |

|---|---|---|

| ETF Launch Success | High | Medium |

| Institutional Accumulation | Moderate-High | High |

| Market Sentiment | Moderate | High |

| Technical Breakout | Moderate | Medium |

According to BTCC's Olivia, 'While $1 represents a significant psychological barrier, the current institutional momentum and ETF catalyst could propel DOGE toward higher valuations, though investors should maintain realistic expectations about the timeline for such moves.'